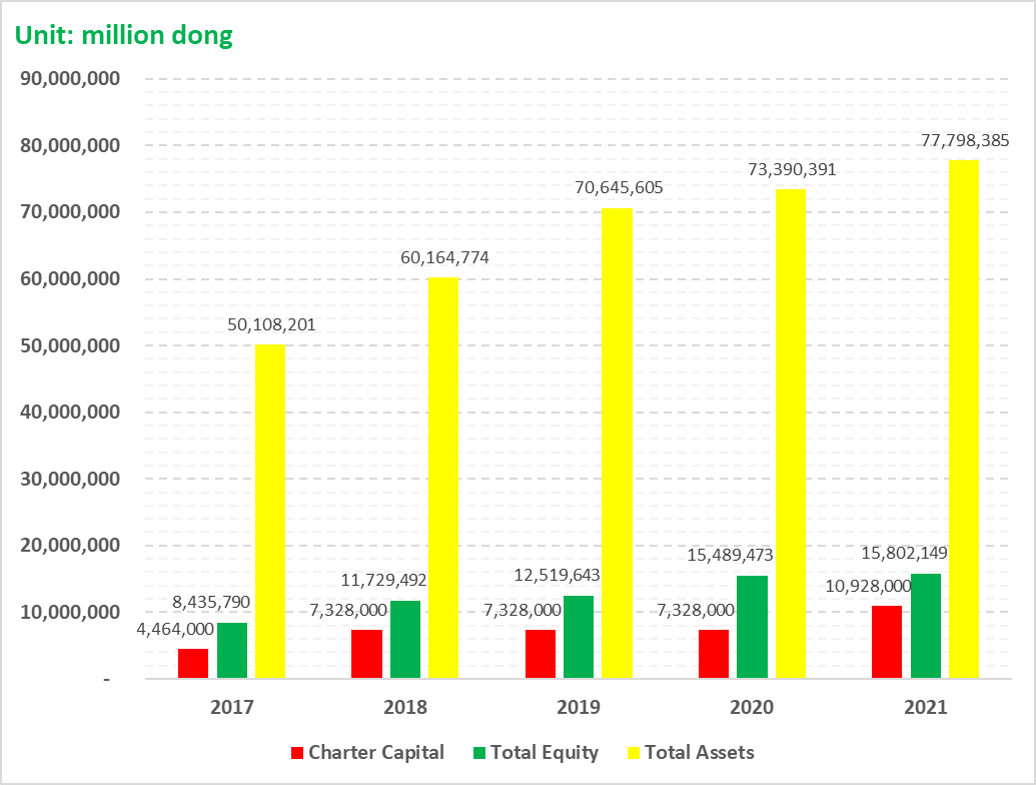

FE CREDIT was valued at USD 2.8 billion and raised its charter capital from VND 7,328 billion to VND 10,928 billion after becoming a strategic partner with SMBC FC (Japan’s leading consumer finance company, under SMBC Banking and Finance Corporation)

Officially changed its name to VPBANK SMBC FINANCE COMPANY LIMITED

Total Assets

Total Assets  Charter Capital

Charter Capital  Total Equity

Total Equity

| Ratio | Reporting Date (Dec 31, 2021) | SBV Regulations | Status (compare with SBV) |

|---|---|---|---|

| Liquidity reserve | 5.35% | >= 1% | Compliance |

| Affordability for 30 days – VND | 37.00% | >= 20% | Compliance |

| Affordability for 30 days – Foreign Currency | Do not generate cash outflows | >=5% | Compliance |

| Short-term funding for medium and long-term loans | 45.78% | <= 90% | Compliance |

| Buying and investing bonds compared to the capital source of the Bank | 1.29% | <= 10% | Compliance |

| Capital adequacy ratio – CAR | 17.79% | >= 9% | Compliance |

Business name: VPBANK SMBC FINANCE COMPANY LIMITED

Abbreviated business name: VPB SMBC FC

Operation status: Active

Business code: 0102180545

Legal type: Limited Liability Company

Established date: February 15, 2007

Legal representative: Mr. LO BANG GIANG

Head office address: 2nd Floor, REE Tower, No. 9, Doan Van Bo Street, Ward 13, District 4, Ho Chi Minh City, Vietnam

Other financial service activities n.e.c. (except insurance and social insurance)

Details: Operating under License No. 64/GP-NHNN dated October 30, 2017 of the Governor of the State Bank of Vietnam.

Sample stamp HERE

– Announcement of financial statements

+ June 2019 (here)

+ December 2019 (here)

+ June 2020 (here)

+ December 2020 (here)

+ June 2021 (here)

+ December 2021 (here)

– Announcement of payment of principal and interest of FE Credit bonds

+ June 2019 (here)

+ December 2019 (here)

+ June 2020 (here)

+ December 2020 (here)

+ June 2021 (here)

+ December 2021 (here)

– Announcement of the capital use

+ June 2021 (here)

+ December 2021 (here)

– Announcement of Bond issuance results

+ The year 2020:

• Special report about issuance results– 01 (here)

• Special report about issuance results– 02 (here)

• Special report about issuance results– 03 (here)

• Special report about issuance results– 04 (here)

• Special report about issuance results– 05 (here)

• Special report about issuance results– 06 (here)

• Special report about issuance results– 07 (here)

• Special report about issuance results– 08 (here)

• Special report about issuance results– 09 (here)

+ The year 2021:

• Special report about issuance results – 01 (here)

• Special report about issuance results – 02 (here)

• Special report about issuance results – 03 (here)

• Special report about issuance results – 04 (here)

• Special report about issuance results – 05 (here)

• Special report about issuance results – 06 (here)

• Special report about issuance results – 07 (here)

• Special report about issuance results – 08 (here)

• Special report about issuance results – 09(here)

• Special report about issuance results – 10(here)

• Special report about issuance results – 11 (here)

• Special report about issuance results – 12 (here)

• Special report about issuance results – 13 (here)

– Announcement of Bond issuance results

+ List closing date_VPFCH2224001 (here)

+ List closing date_VPFCH2224002 (here)

+ List closing date_VPFCH2224003 (here)

+ List closing date_VPFCH2224004 (here)

+ List closing date_VPFCH2224008 (here)