FE CREDIT has achieved all its sustainability performance targets for its inaugural ESG-compliant loan, aiming for stable and sustainable growth in the future.

HÀ NỘI — VPBank SMBC Finance Company Limited (FE CREDIT’s) ESG commitments were part of a loan agreement worth up to US$100 million between FE CREDIT and Deutsche Bank, Singapore branch, signed on May 7, 2021. The loan set out specific Environmental – Social – Governance (ESG) KPIs and associated targets to measure, monitor and report on FE Credit’s contribution to financial inclusion in Vietnam.

By the end of Q1 of 2022, the number of customers that the company approached reached more than 17.4 million, exceeding the set target by 13 percent. Of these, 7.2 million were women, accounting for more than 41 percent of the total number of customers approached, and exceeding the corresponding target by 12.7 percent.

In addition, the number of borrowers of FE CREDIT during the period was more than 6.3 million people, which exceeded the set target by 51.4 percent. Of these, 2.67 million were women borrowers, exceeding the target by 49 percent.

The results are attributed to close observation of customer behaviour changes and the development of digital lending platforms for clients. In particular, the percentage of online borrowers exceeded the company’s set target by 18 percent of, with the share of loans disbursed online exceeding the target by 92.5 percent.

Notably, during the pandemic, FE CREDIT supported 400,000 loans, worth about VNĐ2 trillion (nearly $85.5 million) with preferential interest rates. Customers were able to borrow while staying at home by applying online for a loan on the FE CREDIT website.

Since June 2021 and in line with SBV guidance, the company has exempted interest payments and cut interest rates for customers by debt group at a time when provinces and cities began to implement social distancing orders. Customers who have financial difficulties or are affected by the pandemic, and are listed into debt groups from 2 to 5 will be considered for partial interest rate exemptions or reductions to assist clients in paying overdue debts and lessen their financial burden.

From August 2021, the company also carried out a programme of interest exemption and reduction per period, meaning that customers who pay the full principal balance and 50 per cent of the interest in the most recent payment period will be given consideration for exemption or cut of the remaining rates. These solutions have assisted more than 130,000 customers affected by the COVID-19, with the amount of interest rate supported of nearly VND 215 billion. Notably, FE Credit provided loans to close to 7,500 previously underserved customers, i.e., customers with limited access to financial services – a key contribution to the financial inclusion agenda, particularly at a time of financial distress.

This is part of the result of many customer support programmes that FE CREDIT has been implementing to assist customers facing difficulties caused by the epidemic.

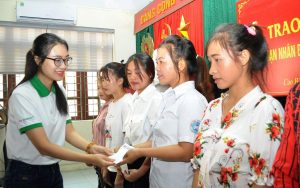

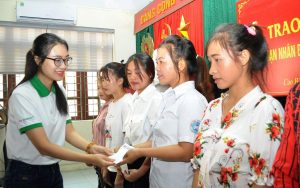

In more than 11 years of development, FE CREDIT has consistently showed interest and involvement in community activities, such as providing hundreds of scholarships to underprivileged students to overcome hardships; helping those affected by floods in the central region; or supporting victims of cross-border trafficking in their reintegration into the community. Although the company was also affected by the COVID-19 pandemic, it was, and remains, willing to dedicate resources to help those in need and actively contribute to social welfare.

FE CREDIT has accompanied many community-oriented initiatives. Photo courtesy of FE CREDIT

“Although the company has just completed its first ESG-compliant loan, this has been the orientation of FE CREDIT since its establishment. We have always believed that activities for the community and society are essential to the growth of enterprises in a sustainable manner. FE CREDIT is currently one of the pioneers of ESG standards in the consumer finance industry,” said a FE CREDIT representative.

The set of standards for measuring ESG indicators was consulted and established by Deutsche Bank and CRISIL. CRISIL is owned by S&P Global Inc., the world’s leading provider of ratings, data, research, and analytics services with headquarters in India. With its rich experience and global footprints, the organisation has provided data analysis services to more than 100,000 clients through businesses operating from India, the UK, Argentina, Poland, China, Hong Kong and Singapore.

(028) 39 111 555

(028) 39 111 555